Irs Loans From 401k

- The law limits the amount you can borrow to the lesser of 50% of your 401 (k) balance or $50,000. Adding some complexity, you can take a loan from your 401 (k), pay it off, and again borrow from your 401 (k). If you make multiple loans, however, the aggregate cannot be more than $50,000 within a 12-month period.

- May 06, 2020 The new law also increases the amount you can borrow from your 401 (k). Through September 22, 2020, you can borrow 100% of your account balance up to $100,000 (less any outstanding loans).

Ideally, everyone would have a savings account or emergency fund to draw on when they face unplanned expenses. But in the real world, it’s common for cash flow to fall short of one’s needs from time-to-time. For many people, their largest financial asset is their retirement savings in a 401(k) account.

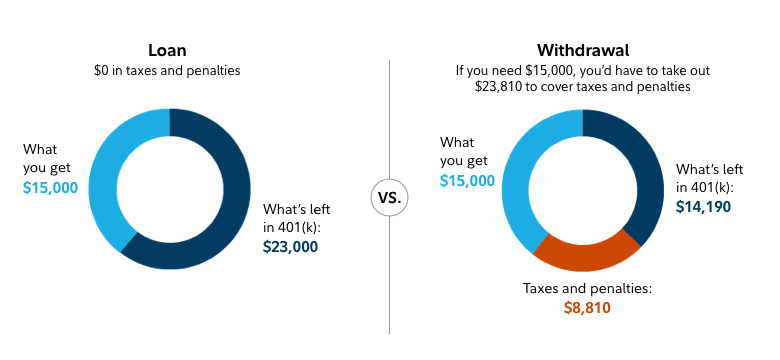

To help individuals manage the challenge of both saving enough for retirement and setting aside money for unplanned expenses, most 401(k) plans allow the business owner and employees to take loans from their 401(k) accounts. When the 401(k) loan is repaid to the plan account, with interest, an individual can stay on track with their retirement savings even while addressing short-term cash needs. But loans that are not repaid can put retirement savings at risk.

401(k) Loan Rules

Irs Loan From 401k Rules

Maximum 401(k) loan

Your 401 (k) plan may also require a minimum loan amount. 2 Under the CARES Act, the IRS increased the dollar limit on 401 (k) loans made between March 27 and Sept. 22, 2020, from $50,000 to $100,000. A loan from your employer’s 401 (k) plan is not taxable if it meets the criteria below. Generally, if permitted by your plan, you may borrow up to 50% of your vested account balance up to a maximum of $50,000. The loan must be repaid within 5 years, unless the loan. Failure to repay your 401 (k) loan on time If you miss your repayment deadline, your employer must file a Form 1099-R with the IRS. That means your remaining loan balance is considered income to you and taxed at your ordinary income tax rate. In addition, you will likely have to pay a penalty of 10% of the balance.

The maximum amount that you may take as a 401(k) loan is generally 50% of your vested account balance, or $50,000, whichever is less. If 50% of your vested account balance is less than $10,000, you may borrow up to $10,000 if your plan allows it.

Loan administration

All 401(k) plan loans must meet the following requirements:

- Each loan must be established under a written loan agreement.

- The business owner must set a commercially reasonable interest rate for plan loans.

- A loan cannot exceed the maximum permitted amount.

- A loan must be repaid within a five-year term (unless used for the purchase of a principal residence).

- Loan repayments must be made at least quarterly and in substantially equal payments that include principal and interest.

The business owner has some flexibility in designing a loan program for their 401(k). For example, they may choose to set a limit on the number of loans an employee may take at one time or within one year or set a minimum dollar amount for a loan.

Irs Rules For Loans From 401k

Optional cookies and other technologies

We use analytics cookies to ensure you get the best experience on our website. You can decline analytics cookies and navigate our website, however cookies must be consented to and enabled prior to using the FreshBooks platform. To learn about how we use your data, please Read our Privacy Policy. Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. You may disable these by changing your browser settings, but this may affect how the website functions.

Irs Rules On Loans From 401k

To learn more about how we use your data, please read our Privacy Statement.