Allocation Of Refund

Nonresident and part-year resident income tax returns

- IT-203, Nonresident and Part-Year Resident Income Tax Return, and instructions (including instructions for IT-195, IT-203-ATT, and IT-203-B)

- IT-203-X, Amended Nonresident and Part-Year Resident Income Tax Return and instructions

Other forms you may need to complete and submit with your return

- IT-203-ATT, Other Tax Credits and Taxes(Attachment to Form IT-203)

- IT-203-B, Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet

- IT-203-C, Nonresident or Part-Year Resident Spouse's Certification

- IT-196, New York Resident, Nonresident, and Part-Year Resident Itemized Deductions

- IT-201-V, Payment Voucher for Income Tax Returns

- IT-225, New York State Modifications, and instructions

- IT-2, Summary of W-2 Statements

- IT-1099-R, Summary of Federal Form 1099-R Statements

- IT-195, Allocation of Refund, (Attachment to Form IT-201 or IT-203)

- IT-227, New York State Voluntary Contributions

- IT-558, New York State Adjustments due to Decoupling from the IRC, and instructions

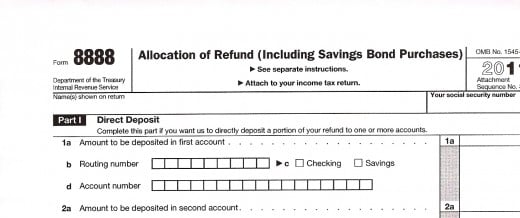

Generally, the rule provides that, if an affiliated group does not have a tax allocation agreement, or unless the agreement unambiguously specifies a different result, a tax refund belongs to the group member responsible for the losses that led to it. The Tenth Circuit applied the Bob Richards rule in this case. About Form 8379, Injured Spouse Allocation The injured spouse on a jointly filed tax return files Form 8379 to get back their share of the joint refund when the joint overpayment is applied to a past-due obligation of the other spouse. Allocation Start Month Allocation Stop month - enter two digits for the months the policy was shared (January = 01, December = 12) Premium Percentage SLCSP Percentage PTC Advance Payment Percentage - enter the allocation percentage from 0 to 100 for the taxpayer on this return that the taxpayers have agreed upon between themselves. Refund claims/applications must be filed within two years from the close of the taxable quarter when the sales were made. Once the claim/application is filed by the taxpayer, the BIR office where the claim was filed is required to act on the refund claim within a mandated 120-day period. Part III Paper Check Part IV Total Allocation of Refund Information about Form 8888 and its instructions is at www.irs.gov/form8888. Attach to your income tax return. 1a 1a b c d 2a 2a b c d 3a 3a b c d 4 4 5a 5a b c 6a 6a b c 7 7 8 8 For Paperwork Reduction Act Notice, see your tax return instructions.

Common credit forms

- IT-215, Claim for Earned Income Credit, and instructions

- IT-216, Claim for Child and Dependent Care Credit, and instructions

See our Income tax credits page for general information on the common credits listed above.

See our Income tax forms page for other personal income tax forms you may need.

General information

The Court holds the Bob Richards rule exceeds federal courts’ common-lawmaking authority.

By Paul BonnerThe U.S. Supreme Court struck down a long-standing common law rule by which federal courts had decided disputes between members of an affiliated group filing a consolidated return over which of them should be allocated any tax refund. Instead, according to the unanimous decision, state laws should be applied to resolve these disputes.

The case, Rodriguez v. Federal Deposit Insurance Corp., No. 18-1269 (U.S. 2/25/20), grew out of a Chapter 7 bankruptcy case involving United Western Bank and its parent corporation, United Western Bancorp Inc. (UWBI). After heavy losses, the Denver-based bank was closed in 2011 and the Federal Deposit Insurance Corp. (FDIC) named receiver. Soon after, UWBI entered bankruptcy, with Simon Rodriguez named as trustee.

Also in 2011, UWBI filed its 2010 consolidated federal income tax return on behalf of its affiliated group that included United Western Bank, claiming a $4.8 million refund based on a carryback of a 2010 net operating loss to offset taxes paid for 2008. The IRS in 2015 issued the refund, depositing it into the bankruptcy court's registry, pending resolution of what had by now become an adversary proceeding between UWBI on the one hand and United Western Bank and the FDIC on the other.

The bankruptcy court, relying on a 2008 tax allocation agreement between UWBI and its affiliated subsidiaries including United Western Bank, held the refund to be part of UWBI's bankruptcy estate (In re United Western Bancorp, Inc., 558 B.R. 409 (Bankr. D. Colo. 2016)). The FDIC then appealed to the district court, which reversed the bankruptcy court (Federal Deposit Ins. Corp. v. Rodriguez, 574 B.R. 876 (D. Colo. 2017)). UWBI appealed to the Tenth Circuit, which affirmed the district court's decision (Rodriguez v. Federal Deposit Ins. Corp., 893 F.3d 716 (2018)), and then to the Supreme Court.

The Court's opinion noted that such disputes between members of affiliated groups without a tax allocation agreement or with a contested one have been decided under a federal common law rule applied in some jurisdictions, known as the Bob Richards rule, after the case out of which it grew, In re Bob Richards Chrysler-Plymouth Corp., 473 F.2d 262 (9th Cir. 1973). Generally, the rule provides that, if an affiliated group does not have a tax allocation agreement, or unless the agreement unambiguously specifies a different result, a tax refund belongs to the group member responsible for the losses that led to it. The Tenth Circuit applied the Bob Richards rule in this case.

However, the Court held that the Bob Richards rule 'is not a legitimate exercise of federal common lawmaking.' Federal courts can create common law only where 'necessary to protect uniquely federal interests,' which the court found were not present in the determination of the allocation of a federal refund between affiliated group members (slip op. at 4, quoting Texas Industries, Inc. v. Radcliff Materials, Inc., 451 U.S. 630, 640 (1981)). Rather, 'state law is well equipped to handle disputes involving corporate property rights,' even in cases that 'happen to involve corporate property rights in the context of a federal bankruptcy and a tax dispute' (slip op. at 5).

The Court remanded the case to the Tenth Circuit for further proceedings consistent with the Court's opinion, noting that the circuit court could reach the same result again under state law.

- Rodriguez v. Federal Deposit Insurance Corp., No. 18-1269 (U.S. 2/25/20)

Irs Direct Deposit

— By Paul Bonner, a JofA senior editor.